Buy Paytm Account

$200.00 Original price was: $200.00.$120.00Current price is: $120.00.

Our Service Always Trusted Customers with sufficient Guarantee

✔ 100% Customer Satisfaction Guaranteed.

✔ 100% Non-Drop Verified Payoneer Accounts

✔ Active Buy Paytm Account

✔ Very Cheap Price.

✔ High-Quality Service.

✔ 100% Money-Back Guarantee.

✔ 24/7 Ready to Customer Support.

✔ Extra Bonuses for every service.

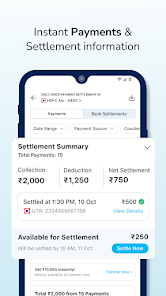

Paytm Account

Looking to shop for a Paytm account? Get instantaneous access to a proven Paytm wallet with all the functions you want to make steady transactions online. Buy now and start using Paytm to ship and acquire money, pay bills, and make purchases hassle-free. Buy a Paytm account for your developing enterprise. This selection does now not permit you to down. Do you want to recognize why? Then study the item to find out the solution.

What is a Paytm Account?

Paytm is an Indian digital wallet and e-commerce payment device that permits customers to shop cash digitally, pay bills, and make purchases online. A Paytm account is essentially a virtual wallet that is linked to a user’s mobile quantity and email cope, which they can use to make transactions effectively and securely.

Users can upload cash to their Paytm account using several charge techniques, such as credit score playing cards, debit cards, internet banking, and UPI (Unified Payments Interface). Paytm additionally offers more than a few different offerings, consisting of cell recharge, bill payments, ticket bookings, and more. With over 450 million registered users, Paytm is one of the maximum broadly used digital charge systems in India and is continuing to make its attain and services throughout the United States of America.

Paytm is an E-commerce charge platform installed in Noida, India, in 2010. It is likewise a financial era-based totally agency. Recently it is to be had in 11 Indian languages. Besides online commercial enterprise payments, it offers many online fee services along with – cellular recharges, price tag bookings, or maybe mobile recharges. It has now emerged as the first payment app in India that crossed 100 million app downloads.

How to Use Paytm?

Paytm is a popular online charge gadget in India that allows users to ship and obtain cash, pay bills, and make purchases. Here’s a step-with the aid of-step manual on how to use Paytm:

- Create a Paytm account: Download the Paytm app from the App Store or Google Play Store and sign on with your mobile quantity and e-mail address. Verify your account by way of getting into the OTP (One Time Password) despatched for your registered mobile quantity.

- Add cash for your Paytm pockets: To use Paytm, you need to add money to your Paytm wallet. You can upload cash for the usage of your credit card, debit card, or net banking.

- Send money: To ship money, go to the “Pay” or “Send Money” alternative in the app, and enter the recipient’s mobile variety and the quantity you want to send. You also can upload a message for the recipient in case you want. Confirm the details and enter your Paytm password to complete the transaction.

- Pay payments: Paytm lets you pay various payments which include electricity, water, fuel, and cellular bills. To pay a bill, go to the “Pay Bills” choice in the app, pick the invoice you need to pay, input the billing info, and verify the fee.

- Make purchases: You can use Paytm to make purchases from various online and offline traders. To make a buy, choose the “Pay with Paytm” alternative on the checkout web page, enter the quantity you want to pay, and verify the fee.

- Withdraw cash: You can withdraw money from your Paytm wallet in your bank account. To do so, visit the “Passbook” option in the app, select “Paytm Wallet,” and then pick “Send Money to Bank.” Enter the quantity you want to withdraw, choose the bank account, and verify the transaction.

Paytm also offers other features such as booking film tickets, train tickets, and flights and availing of cashback and discounts on diverse transactions. Overall, Paytm is a convenient and consumer-pleasant fee device that lets customers manipulate their budget from the comfort of their smartphones.

Top Features of Paytm

Paytm is a popular virtual pockets and price platform in India, offering a wide range of functions to make online transactions easy, short, and stable. Here are some of the top features of Paytm:

- Digital Wallet: Paytm gives a digital wallet feature, allowing customers to keep cash digitally and make payments conveniently without the want for physical coins.

- Send and Receive Money: Paytm lets users send and receive cash quickly and without problems to friends, circle of relatives, or traders.

- Bill Payments: Paytm allows users to pay bills for numerous services like power, water, gas, and more.

- Mobile Recharge: Users can without difficulty recharge their mobile phones with the use of Paytm, and revel in extraordinary reductions and cashback.

- Online Shopping: Paytm additionally provides an internet shopping platform wherein customers can purchase merchandise starting from electronics to apparel, and more.

- UPI Payments: Paytm helps UPI (Unified Payments Interface) bills, permitting customers to transfer funds instantly between financial institution accounts.

- QR Code Payments: Paytm permits customers to make bills using scanning a QR code with their smartphones, that’s a short and handy way to make payments.

- Credit Card Bill Payments: Paytm additionally enables users to pay their credit card bills without delay through the app.

- Digital Gold: Paytm allows users to purchase and sell gold digitally, making it a secure and stable way to put money into gold.

- 24×7 Customer Support: Paytm gives 24×7 customer support to solve any queries or issues that users may additionally face.

Overall, Paytm offers quite several features that make it a convenient and dependable charge platform for customers in India.

Things that You Don’t Know About Paytm

Here we gift a listing that you can pass over out first out or do no longer recognize about Paytm –

- Scan the QR code from the photo gallery.

- You can speedy test the internet balance by using the Paytm passbook.

- You can shop for a debit or credit card with the profile menu.

- By tapping on Paytm assured or brand authorized, you could shortlist the sellers.

- To shop sometimes, you can cross for a one-touch retry for pending orders.

- You can quickly flip off the push notification with the aid of the usage of notification settings.

- Paytm affords a toll-unfastened wide variety to recognize about Paytm wallet.

- Also, you can upload money from the fee display.

Why Should You Buy a Paytm Account?

If you want a dependable fee gateway for your business, then no doubt Paytm can be the proper desire! In post-pandemic situations, the demand for online or cashless payments has extended every day. So, you need to purchase a Paytm account due to the fact –

- It helps each mode of price.

- Paytm is a secure and relied-on platform.

- It has a better achievement rate.

- In Paytm, users have the choice of checkout with stored playing cards. So, it will help to lower the transaction time.

- It additionally includes actual-time bank settlements.

- It offers traders get right of entry to a dashboard. So, it will help to track the fulfillment fee and examine client calls.

What to Do Before Joining Paytm?

Before joining Paytm, there are some things you should not forget to ensure a smooth experience:

- Check compatibility: Make certain your cellular telephone is compatible with the Paytm app. Paytm calls for Android five.0 or above, or iOS 9. Zero or above.

- Verify your mobile number: Your Paytm account is connected to your cell variety, so make sure your number is lively and can acquire SMS messages.

- Verify your e-mail cope with: You will need to affirm your email deal with to activate your Paytm account, so ensure your email cope with is active and handy.

- Link your bank account: To make transactions, you may want to link your bank account to your Paytm account. Make sure you’ve got the vital bank info and documents, such as your account number, IFSC code, and PAN card.

- Check for offers: Paytm gives numerous cashback and cut-price offers, so make certain to test for any ongoing gives earlier than becoming a member of.

- Security issues: Paytm is a steady platform, but it’s miles usually recommended to take precautions including the use of robust passwords, now not sharing your login information with everyone, and permitting two-issue authentication.

By considering those points, you can ensure a clean and trouble-loose revel when joining Paytm.

In conclusion,

Paytm is a popular virtual pockets and price platform in India, presenting a wide range of functions to make online transactions easy, short, and steady. With its digital wallet feature, users can keep cash digitally and make bills without problems without the want for bodily cash. Paytm offers many services, including sending and receiving money, bill payments, mobile recharges, online shopping, and more.

By verifying your cellular number and e-mail address, linking your bank account, and taking necessary security precautions, you can be part of Paytm and revel in the benefits and reliability of a trusted fee platform.

Paytm affords rapid transactions and also gives a consumer interface, on-the-spot payment. Besides, it presents an extensive variety of services and products for its clients. So, purchase a Paytm account additionally buy a tested Paytm account, and enjoy all of its services.

Related products: Buy Reddit Ads Accounts

Related products

-

Payment Gateway

Buy iCard Account

Rated 4.50 out of 5$250.00Original price was: $250.00.$150.00Current price is: $150.00. Add to cart -

Payment Gateway

Buy Cash App Account

$100.00 – $500.00 Select options This product has multiple variants. The options may be chosen on the product pageRated 0 out of 5 -

Payment Gateway

Buy Paxful Accounts

$200.00 – $260.00 Select options This product has multiple variants. The options may be chosen on the product pageRated 0 out of 5 -

Payment Gateway

Buy Amazon Pay Accounts

Rated 0 out of 5$160.00Original price was: $160.00.$140.00Current price is: $140.00. Add to cart

Reviews

There are no reviews yet.